Nj Cash Buyers Can Be Fun For Everyone

Table of Contents8 Easy Facts About Nj Cash Buyers ExplainedRumored Buzz on Nj Cash BuyersSome Known Details About Nj Cash Buyers The smart Trick of Nj Cash Buyers That Nobody is Discussing

Many states provide consumers a specific level of protection from creditors regarding their home. "That indicates, no matter of the worth of the house, financial institutions can not force its sale to satisfy their insurance claims," states Semrad.If your home, as an example, deserves $500,000 and the home's home mortgage is $400,000, your homestead exception could stop the forced sale of your home in order to pay financial institutions the $100,000 of equity in your home, as long as your state's homestead exception is at least $100,000. If your state's exception is less than $100,000, a insolvency trustee might still require the sale of your home to pay lenders with the home's equity over of the exemption. If you fail to pay your building, state, or federal taxes, you could lose your home through a tax lien. Acquiring a home is much easier with money.

(https://letterboxd.com/njcashbuyers1/)Aug. 7, 2023 In today's hot market, especially in the Palm Coastline Gardens and Jupiter property area, cash deals can be king but, there are reasons that you may not wish to pay cash. I know that lots of vendors are a lot more likely to approve a deal of cash money, yet the seller will obtain the cash no matter of whether it is funded or all-cash.

More About Nj Cash Buyers

Today, regarding 30% people property buyers pay cash money for their buildings. That's still in the minority. There might be some excellent reasons not to pay money. If you simply have sufficient money to pay for a home, you might not have any kind of left over for repair work or emergency situations. If you have the cash, it might be a great idea to set it apart to ensure that you contend least 3 months of real estate and living costs need to something unexpected take place was losing a job or having clinical concerns.

You could have certifications for an exceptional home loan. According to a current research by Cash magazine, Generation X and millennials are considered to be populaces with one of the most prospective for development as debtors. Taking on a bit of debt, specifically for tax obligation objectives fantastic terms could be a far better option for your financial resources overall.

Perhaps spending in the stock exchange, mutual funds or a personal organization may be a far better option for you in the future. By buying a building with cash, you run the risk of depleting your get funds, leaving you susceptible to unforeseen maintenance costs. Owning a property requires continuous expenses, and without a mortgage cushion, unforeseen repairs or remodellings could stress your financial resources and hinder your capability to preserve the property's problem.

Rumored Buzz on Nj Cash Buyers

Home costs fluctuate with the economy so unless you're intending on hanging onto your home for 10 to three decades, you may be far better off spending that cash money in other places. Buying a property with cash can expedite the buying procedure dramatically. Without the requirement for a home loan approval and connected documents, the purchase can shut much faster, giving an one-upmanship in affordable realty markets where sellers may prefer cash money purchasers.

This can result in significant cost financial savings over the lengthy term, as you won't be paying passion on the car loan quantity. Cash money customers frequently have more powerful settlement power when taking care of vendors. A money offer is much more eye-catching to sellers since it lowers the threat of a bargain falling through because of mortgage-related problems.

Remember, there is no one-size-fits-all option; it's important to tailor your decision based upon your individual scenarios and lasting aspirations. All set to start checking out homes? Give me a call anytime.

Whether you're selling off properties for a financial investment property or are vigilantly conserving to buy your dream residence, getting a home in all cash money can significantly raise your acquiring power. It's a tactical relocation that strengthens your setting as a buyer and enhances your versatility in the realty market. Nevertheless, it can place you in a monetarily prone area (NJ CASH BUYERS).

The Best Guide To Nj Cash Buyers

Saving money on interest is one of one of the most common factors to buy a home in cash money. Throughout a 30-year home mortgage, you might pay 10s of thousands or perhaps numerous thousands of dollars in complete passion. Furthermore, your buying power increases without funding contingencies, you can discover a more comprehensive selection of homes.

The greatest threat of paying money for a house is that it can make your financial resources unpredictable. Binding your liquid properties in a property can lower financial flexibility and make it a lot more tough to cover unforeseen expenditures. Furthermore, binding your cash implies losing out on high-earning financial investment opportunities that could yield greater returns elsewhere.

Jonathan Taylor Thomas Then & Now!

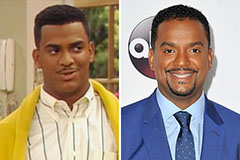

Jonathan Taylor Thomas Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!